GlobalPro Storm Center

GlobalPro aims to keep you informed and up-to-date on all storm related activity and news.

Update August 30, 2023: Understanding Hurricane Idalia: Insurance Coverage Insights for Policyholders

Hurricane Idalia recently made landfall in the lightly populated Big Bend region of Florida, causing significant damage along its path. The GlobalPro Team hopes that everyone weathered the storm, and is safe and sound.

Idalia arrived as a formidable Category 3 hurricane with sustained winds of up to 125 mph (205 kph), leaving a trail of destruction when it hit near Keaton Beach at 7:45 a.m. Even an hour later, it maintained Category 2 hurricane status with top winds of 110 mph (175 mph).

For condo associations and Homeowners in the affected areas, understanding insurance coverage is vital.

Here are key points to consider:

- Master Insurance Policy: Condo associations typically have a master insurance policy that covers common areas and the building structure. Review this policy to understand what it covers and what it excludes. It’s essential to know the deductible and the coverage limits.

- Unit Owner Insurance: Encourage unit owners to have their own insurance policies (HO-6 policies). These policies cover personal belongings and interior fixtures, as well as provide liability coverage. Remind unit owners of the importance of maintaining their individual coverage.

- Wind and Flood Insurance: Ensure that the master policy includes coverage for wind damage, which is crucial during hurricane season. Standard policies often don’t cover flood damage, so consider obtaining a separate flood insurance policy through the NFIP or a private insurer if your condo association is in a flood-prone area.

- Document Damage: Remember the Three D’s of Damage! (see below) If your property has suffered damage, document it meticulously. Take photos and videos of the damage before initiating any repairs. This documentation will be essential when filing a claim.

- File Promptly, BUT, don’t rush: Insurance companies often require policyholders to file claims promptly. All policies provide specific notice requirements, and post-loss duties, that Insureds need to comply with. Promptly doesn’t me immediately, however. Document first, then provide a concise Be prepared to provide all necessary information, including the date and time of the damage, a detailed description, and your contact information.

- Temporary Living Expenses: If your home is uninhabitable due to the hurricane’s damage, your policy may provide coverage for temporary living expenses. Keep all receipts and records related to these expenses, as they can be reimbursed under your policy.

- Flood Insurance: Standard homeowners’ insurance policies typically do not cover flood damage. If your property is in a flood-prone area, you should have a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer.

- Stay Informed: Keep yourself updated on any announcements or guidelines from local authorities. They often provide crucial information on the claims process and available assistance.

Hurricane Idalia has left a significant impact on the Big Bend region of Florida, and condo associations in affected areas must be well-prepared regarding their insurance coverage. Understanding the master policy, promoting unit owner insurance, and documenting damage are essential steps. By following these guidelines, condo associations can navigate the post-hurricane period more effectively and ensure the protection of their valuable assets.

Call the GlobalPro Insurance Coverage Experts for personalized assistance during this challenging time. Stay safe and safeguard your condominium community and its residents.

Mastering the Three D’s of Damage: Document, Describe, Defend!

In the face of a hurricane’s fury, your path to recovery is illuminated by these vital steps:

Document – Capture the chaos with unwavering detail. Use your lens as a compass through the storm’s aftermath. Snap pictures, record videos, even unleash a drone if possible. Every image etches a part of your journey.

Describe – Precision matters when recounting the damage. Be concise, yet crystal clear. It’s not just any water damage; it’s hurricane-related. Not wind-driven rain, but the hurricane’s impact. And never to be confused with mold-related woes. Clarity is your ally.

Defend – In the quest for recovery, defending your rights is paramount. Use your comprehensive documentation to substantiate your claim. Comply with all notice requirements and post-loss duties meticulously. Insist that your insurer investigates and fulfills their statutory and contractual obligations.

But here’s the secret ingredient to success: Should you, your association, or your business experience loss or damage, CALL US FIRST!

With GlobalPro, your insurance coverage expert, you’re not alone in this journey. We’re here before, during, and after any loss or damage, providing the pedigree and experience you need.

For more updates and tips stay tuned right here to the GlobalPro Storm Center, follow us on social media and Linkedin!

The GlobalPro Team stands ready to assist your community association, your business, and you with all of our resources.

855.487.7475 | Recover@globalpro.com | https://globalpro.com

For Policyholders affected by Hurricane or Flood:

To find out how we can assist you, please CLICK HERE

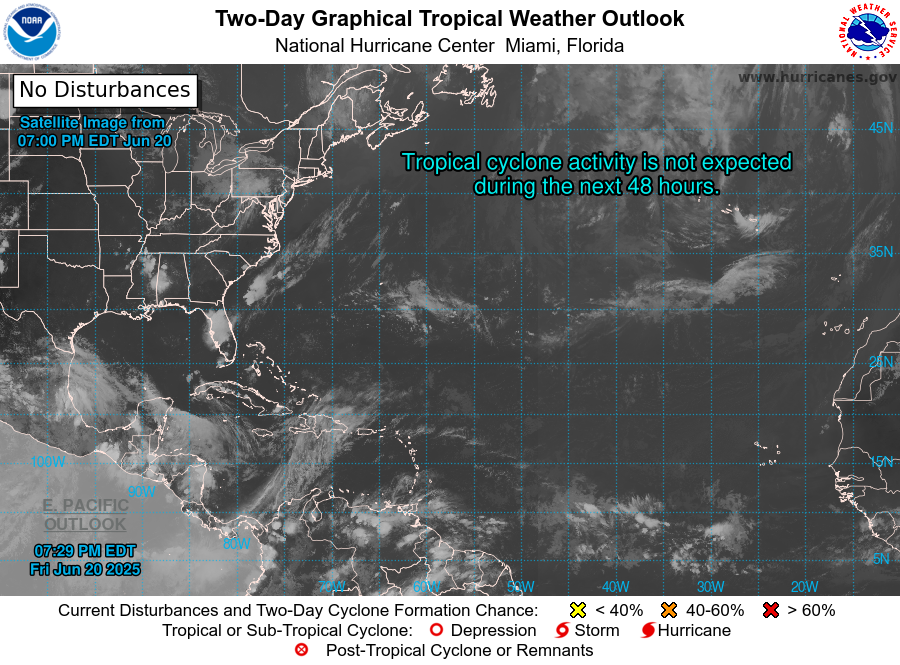

National Hurricane Center

You can find the most up-to-date information regarding current storm activity from the National Hurricane Center – HERE

Get Prepared, Get GlobalPro

Head over to our GlobalPro channel to learn more about managing your risk to recovery, and more! – Click Here

Important Storm Center Resources:

We have compiled some of the most important information your Community Association, Commercial Property, Business, and other valuable property needs to manage your risk to recovery: Insurance Claim Do’s and Don’ts

Storm and Hurricane Checklist

Stock your home with emergency supplies including nonperishable food and water, prescription medications, and a first aid kit.

Turn off the electricity if you see sparks or frayed wires until an electrician has inspected your system for safety.

Turn off the main water valve if pipes are damaged.

Check with local authorities before using any water; the water could be contaminated and may need to be boiled before use.

Prevent mold by removing wet contents immediately but only after documenting the water damage with photos and videos.

Keep a copy of your insurance policy handy.

Take photographs and videos of all damaged areas and document any lost items.

Don't panic… know that help is one call away.

GlobalPro Media Features Discussing Storm Preparations

We are here to help.

Drawing on decades of experience, GlobalPro represents the interests of our select clientele, offering a fully coordinated approach to managing these risks to recovery. That is the GlobalPro difference!